Table of Content

The Best Instant Loan Apps in UAE for Residents Desiring Swift Financial Solutions

In today’s fast-paced and dynamic financial landscape of the United Arab Emirates (UAE), the emergence of instant loan apps has transformed the way individuals access funds. These innovative financial tools are a growing necessity both for the local and for the expat communities living there.

And these platforms cater to the ever-growing demand for quick and hassle-free financial solutions in a country known for its thriving economy. Built with advanced features, UAE loan apps operate on the principle of providing users with immediate access to funds, often with minimal documentation and swift approval processes.

So, whether it’s an unexpected expense, a hard to miss business opportunity, or a personal milestone, these top apps in UAE aim to bridge the gap between financial need and fulfillment. And they do so by offering a convenient alternative to traditional banking channels.

A diverse range of financial platforms, each with its unique features and benefits, characterizes the UAE loan app market. From user-friendly interfaces to advanced algorithms that assess creditworthiness, these apps leverage cutting-edge technology to streamline the lending process. In this blog, we will explore the intricacies of these apps, shedding light on their mechanisms, benefits, and the evolving landscape of the UAE’s financial ecosystem. Let’s first start from the basics below.

The Rising Popularity of Cash Loan Apps in UAE and More

The rising popularity of instant loan apps in UAE can be attributed to several factors that collectively address the evolving needs of the country’s diverse population. Firstly, the fast-paced nature of life in the UAE, especially in cities like Dubai and Abu Dhabi, demands quick and efficient financial options.

The popular loan apps in UAE provide a remedy to the time-consuming processes associated with traditional banking, allowing users to access funds within minutes, often with minimal documentation. This is the core reason that encourages companies to develop a UAE loan app by taking professional mobile app development services.

Moreover, the increasing digitization of financial services has played a pivotal role in the widespread adoption of instant loan apps. With a smartphone in nearly every pocket, these cash loan apps in UAE leverage technology to create a seamless user experience. The intuitive interfaces, coupled with robust security measures, instill confidence in users to explore these platforms such as the FinBin loan app in UAE for their financial needs.

The accessibility of these apps also extends to broader demographic, reaching individuals who may be underserved or excluded from traditional banking systems due to various reasons. By offering them the option of getting loans, the best loan apps in UAE serve to empower and equip an entirely new group of people into viable market consumers down the road. Additionally, the flexibility offered by instant loan apps contributes to their popularity. Users can customize loan amounts, tenures, and repayment schedules according to their specific requirements and payment capability. This adaptability aligns with the diverse financial goals and circumstances of individuals in the UAE, from expatriates looking to cover unexpected expenses easily to entrepreneurs seeking quick capital infusion for their ventures.

Best Loan Apps in UAE – What Are the Top Options for You?

There are plenty of instant loan apps working in the financial market of UAE. These apps have brought a great ease for the citizens and other residents across the United Arab Emirates to request funds anytime from highly reputable companies. And while there are a few companies whose claims like “instant cash loan in 1 hour without documents in UAE” may sound a bit suspect, many well-reputed apps do offer similar instant cash loans for those who qualify.

What makes them so great is that unlike the traditional loan shark’s scam many people fall prey to, these loan apps instead follows a transparent process to approve funds as loans for its applicants efficiently. And by keeping it all above board, it instills a sense of trust in these loan apps in UAE.

If you do not know much about these cash loan apps or the best money making apps in UAE, take a look at some of the popular names given below. Ranked among the best in the country, these loan apps can come in handy for you if you are in the UAE and find yourself suddenly needing a quick cash loan in an emergency, without having to go to the bank.

Let’s find out which instant loan apps you should use in the UAE.

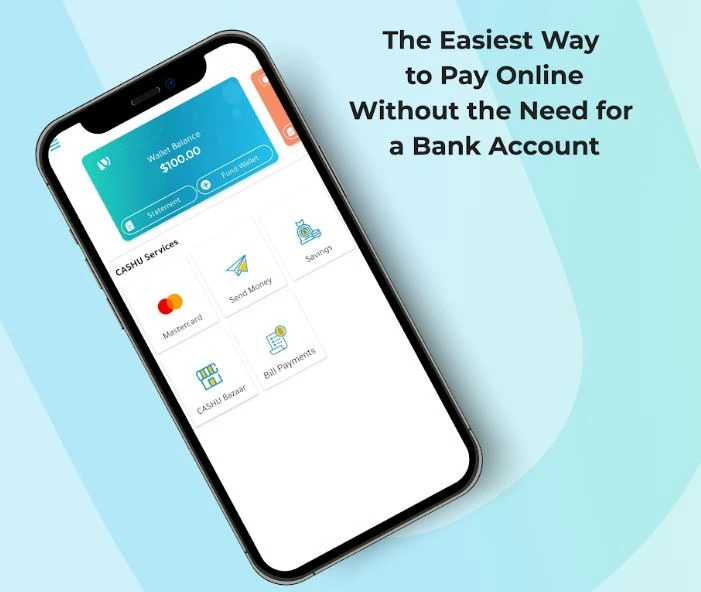

CashU Quick Loan App

CashU stands out as one of the best loan apps in UAE, renowned for its expeditious and accessible cash solutions. Boasting a diverse array of flexible loan options, CashU loan app UAE caters to individual needs through a straightforward and user-friendly application process. Employing cutting-edge technology, CashU takes the hassle out of loan applications by swiftly assessing eligibility and delivering decisions within mere minutes.

Whether confronted with an unforeseen expense or aiming to facilitate a substantial purchase, CashU loan app UAE emerges as the quintessential solution for those seeking prompt and hassle-free funds. Embrace the convenience and peace of mind that come with borrowing through CashU by downloading the fintech app today and navigating your financial journey with confidence.

FinBin Loan App

FinBin stands out as the best loan app in UAE, providing unparalleled access to swift and cost-effective cash loans. Distinguished by its user-centric approach, FinBin loan app offers an exceptionally intuitive application process characterized by a streamlined interface and rapid approval times. Leveraging sophisticated algorithms, the app meticulously assesses your loan eligibility, ensuring the provision of the most advantageous loan offer tailored to your specific needs. Beyond its commitment to expeditious financial solutions, FinBin loan app UAE shines with its diverse array of flexible loan options, making it the optimal choice for individuals in search of a rapid and convenient borrowing experience. The app not only prioritizes customer satisfaction but also excels in providing seamless loan management features. Download FinBin loan app from Google or App Store today, as the platform is termed perfect to cover all your immediate funding needs.

Cash App Loan App UAE

Cash App is a widely popular mobile payment app known for its simplicity and versatility. Cash App enables users to send and receive money in a hassle free way. While it primarily serves as a peer-to-peer payment platform, it has expanded its offerings to include features that align with users’ financial needs, making it a multifaceted tool in personal finance.

Just like mobile banking apps, Cash App’s straightforward interface and ability to seamlessly integrate various financial functions have contributed to its widespread adoption, especially among younger demographics. Its user-friendly design, quick money transfer capabilities, and additional features like the Cash Card make it a versatile tool for everyday financial activities, as well as one of the top options for loan apps in UAE.

IOU Loan App UAE

IOU stands out as a premier loan application in the UAE, delivering swift and convenient access to funds. Streamlining the borrowing experience, IOU loan app in UAE eliminates the need for lengthy paperwork or intricate procedures, employing advanced technology to swiftly evaluate loan eligibility and ensure a hassle-free process.

Boasting a user-friendly interface, IOU loan app in UAE simplifies the application process, allowing users to effortlessly apply for a loan, monitor repayment progress, and effectively manage their finances. Whether faced with an unexpected expense or seeking financial support for a significant purchase, IOU emerges as the optimal solution for those in search of prompt and convenient cash access.

Credy Instant Loan Application

Credy stands out as one of the most highly sought-after quick cash loan apps in UAE, renowned for its versatility in catering to diverse financial needs. Within its array of offerings, Credy provides an extensive selection of loan options, encompassing personal loans, credit card refinancing, and business loans, establishing itself as a comprehensive financial solution for a broad spectrum of users.

The simplicity of applying for a loan through Credy is a defining feature, allowing users to complete the application in just a few minutes. This streamlined process not only saves time but also aligns with the fast-paced nature of financial decisions in the dynamic UAE market. Additionally, Credy distinguishes itself from other cash loan apps in UAE by offering a flexible repayment schedule, accommodating various financial situations and preferences.

FlexxPay Loan App

FlexxPay, a relatively recent addition to the list of instant loan apps in UAE, is rapidly garnering attention and popularity among users. Distinguishing itself with a focus on providing instant cash loans in the UAE, FlexxPay enables users to borrow an amount equal to their salary. The application process is marked by its simplicity, designed to streamline the borrowing experience for users seeking quick financial solutions.

As part of its commitment to expedience, users can anticipate the transfer of the loan amount to their bank accounts within a remarkably swift timeframe of 24 hours, further enhancing the app’s appeal in meeting urgent financial needs. The emergence of FlexxPay in the UAE’s financial landscape highlights a growing demand for accessible and rapid loan services, and its features suggest a promising player in the competitive arena of cash loan apps in UAE.

Beehive Quick Loan Application in UAE

Beehive was founded with the mission of supporting companies that require quick and accessible funding solutions. Headquartered in Dubai, Beehive operates as an enterprise-level business that focuses on providing peer-to-peer financing options. By leveraging innovative financial technology, Beehive builds a direct link for the businesses seeking decent capital, all within a regulated framework overseen by the Dubai Financial Services Authority (DFSA).

The company is dedicated to offering a more efficient and cost-effective alternative to traditional finance. Through its peer-to-peer model, Beehive cash loan app in UAE eliminates the need for intermediaries like banks, which often add complexity, time, and additional costs to the borrowing process. This streamlined approach allows businesses to access the funds they need more quickly, enabling them to focus on growth and development without the burden of excessive financial overhead.

Emirates NBD Personal Loan App

The Emirates NBD app offers a range of personal loan solutions designed to provide customers with quick and convenient access to funds. These loans cater to various financial needs, whether for unexpected expenses, home renovations, education, or consolidating debt. The UAE loan app allows users to easily apply for a personal loan directly from their mobile devices, with a streamlined digital process that includes quick approvals and minimal documentation.

In addition to the convenience of applying for a loan online, the Emirates NBD cash loan app in UAE provides users with tools to manage their loans effectively. Customers can track their loan status, view repayment schedules, and even make early payments directly through the app, offering a transparent and hassle-free experience. This cash loan app in UAE also provides personalized offers and updates based on the customer’s financial profile, ensuring that the loan terms align with their unique financial situation.

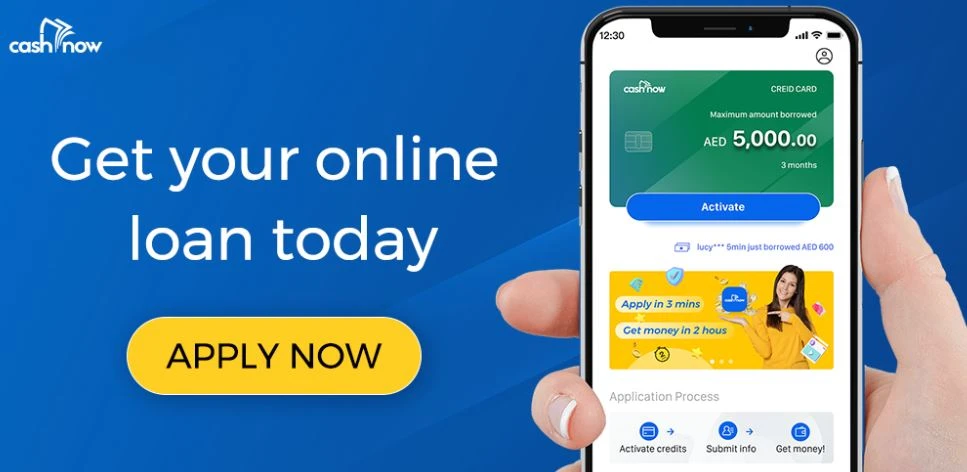

CashNow Instant Cash Loan App UAE

CashNow simplifies the process of obtaining personal loans, making it quick and accessible for users in need of immediate funds. With just a few taps on the app, users can apply for a loan tailored to their urgent financial needs, whether it’s for medical emergencies, unplanned expenses, or any short-term financial requirement. The application process is designed to be user-friendly, so that everyone can use it without facing any technical difficulties.

The simplicity and speed of the loan approval process make CashNow loan app in UAE is a popular choice among many Emiratis seeking quick financial solutions. The app’s ability to provide instant loan approvals and disbursements directly to the user’s bank account sets it apart from more conventional lending methods. Additionally, the app’s user interface is intuitive, making it easy for individuals to navigate through the steps and complete their loan applications without any hassle.

Mashreq Neobiz Loan Solutions App

The Mashreq NeoBiz app offers tailored loan solutions designed specifically for small and medium-sized enterprises (SMEs) and startup. NeoBiz, Mashreq Bank’s digital banking platform focuses on simplifying business banking by offering quick and hassle-free loans that can be applied for directly through the app. With minimal documentation requirements and a fully digital application process, people can quickly access working capital loans to manage cash flow, fund expansion, and other business related expenses.

What makes the NeoBiz loan app in UAE particularly appealing is its emphasis on a seamless, user-friendly experience that caters to the fast-paced needs of business owners. The app provides real-time updates on loan status, transparent terms, and competitive interest rates, making it easy for businesses to plan and manage their finances effectively. By combining a robust suite of financial tools with quick access to funding, Mashreq NeoBiz is well-positioned to support the growth and sustainability of SMEs and startups in the UAE.

Prime Loans Application

The Prime Loans app, based in the UAE, is a digital platform that specializes in offering a variety of personal loan options to cater to the diverse financial needs of its users. Designed to provide a seamless and user-friendly experience, this loan app in UAE allows customers to explore different loan products, compare interest rates, and choose repayment plans that best suit their financial situations. The app is tailored to meet the needs of UAE residents, ensuring that loan offerings are aligned with local regulations and financial norms.

What sets Prime Loans apart is its commitment to transparency, flexibility, and personalized financial solutions. This instant loan app in UAE provides detailed information about each loan product, including interest rates, repayment terms, and any associated fees, allowing users to make informed decisions. With its focus on simplicity and customer-centric features, Prime Loans has become a preferred choice for many UAE residents seeking a reliable and efficient way to access personal loans.

RAKBANK Personal Loan App

The RAKBANK app offers a comprehensive loan feature designed to provide quick and easy access to personal loans for its customers in the UAE. Through the app, users can apply for personal loans tailored to various needs, such as home renovations, education expenses, medical emergencies, or debt consolidation. The application process is fully digital, enabling customers to complete their loan applications in just a few steps with minimal paperwork.

One of the standout features of the RAKBANK loan app’s fund offerings is its flexibility and user-centric design. The app provides clear visibility into the loan status, repayment schedule, and outstanding balances, helping customers manage their loans more effectively. Additionally, personalized loan offers are generated based on the customer’s banking history, ensuring that users receive options that best align with their needs.

LendMe Quick Loan Application

Monami Tech, a leading fintech payment company based in the UAE, has introduced the LendMe app to revolutionize how users access instant loans through various channels. This innovative app is designed to cater to the growing demand for quick and hassle-free financial solutions, offering a digital-first approach to lending. LendMe allows users to explore different loan products and apply for them directly through the app, streamlining the borrowing process and eliminating the need for lengthy paperwork and in-person visits.

The primary goal of LendMe loan app in UAE is to simplify and accelerate the process of obtaining funds by allowing users to submit loan applications quickly and receive real-time reviews. The app’s intelligent system evaluates each application based on predefined eligibility criteria and grants immediate approval for those who qualify. This feature is particularly beneficial for those seeking urgent financial assistance, whether for personal expenses, business needs, or other purposes.

ADCB Hayyak Easy Loans Application in UAE

The ADCB Hayyak app offers a range of benefits for users seeking to access loans quickly and conveniently. One of the primary advantages is its fully digital and user-friendly loan application process, which allows users to apply for personal loans directly through the app without the need for visiting a bank branch. With just a few taps, users can submit their application, upload necessary documents, and receive instant approval notifications if they meet the eligibility criteria.

Another significant benefit of accessing loans through the ADCB Hayyak loan app UAE is the enhanced convenience and control it provides to users over their borrowing experience. It is one of the best loan apps in UAE that helps customers to manage their loans according to their financial situation, providing peace of mind and reducing the stress typically associated with borrowing. By combining convenience, and transparency, the ADCB Hayyak app empowers users to take control of their financial needs.

Crafting Your Own Path: Essential Steps for UAE Loan App Development

To develop a quality UAE loan app, you need to follow some important steps. A lot of times, developers fail to pay attention to these factors, which is what leads them towards making mistakes. If you are new to the field having no knowledge about the process of mobile app development, take a look at the key points defined below to understand how loan apps in UAE should be developed.

Utilizing Market Intelligence for Your Loan App’s Excellence

The first thing that is important in loan app development is the market research. Experts often recommend to first seeing how everyone is working in this industry. As a beginner, you need to understand some important concepts of this field before launching any credit app related to it. You can precisely do so by analyzing the working processes of different established companies, as that will give you a clear picture of loan app development.

Hashing Out Unique Features for Your Loan App’s Success

Once you have conducted proper market research, you would precisely know what type of features should be present in an ideal cash loan app in UAE. It is certainly important to develop these apps using unique features, as that helps to make the platform stand out among others. Some common features like quick registration, hassle-free loan grant and others should be given the first priority, as they define the bases of any professional UAE loan app.

Establish the Right Technological Foundations – Choosing the Optimal Stack

Another thing that is important for loan app development is the correct selection of technology stack. Right now, there are tons of app development tools available in the market, but you need to pick specific ones as per your project requirements. Ideally, it is best advised to use coding languages for app development like Kotlin and Java for app development. These languages are quite advanced, allowing you to develop all types of cash loan apps in UAE efficiently.

Prioritizing the Building of User-Centric Features for Your Loan Apps in UAE

When building an instant loan app in UAE, you need to add some specific features that can make the app stand out among others. A lot of stakeholders think that by just offering a registration and loan approval feature will make the app work. Unfortunately, that is not the case, as you need to do a lot more in the loan app to make it work in the market.

Seamless Onboarding Experience

The first feature that should be simple and streamlined is the registration process. It is recommended to make the onboarding as simple as you can. Anyone who wants to use your cash loan app in UAE should be able to easily register on it. There should not be much detailed requirements in the registration process, as that often forces people to shy away. It is recommended to keep this feature simple, so that people can quickly register on the app.

Quick Approval Process

Some times, people complain about the lengthy approval process of many instant loan apps in UAE. This is something that irritates them very much, because no one wants to wait too long to access emergency funds. If you are developing a quick cash loan app in UAE, it is best recommended to keep its approval process fast and easy. Yes, this process should have some prior verifications, but those prerequisites should be also handled keeping the convenience of users in mind.

Intuitive Loan Tracking System

A loan tracking system should also be designed to let everyone know about the status of loans. It can work best in those scenarios in which users are required to know the approval/rejection of their loans. Additionally, it could also have a feature defining the total time in which the loan should be returned. That is how loan management becomes easy for both parties.

Tailored Repayment Flexibility

Offering a flexible repayment option is also a key feature of the Dubai loan apps. It is best advised to design the repayment option as per the convenience of users. This is one of those areas that could attract tons of customers quickly. The reason is that everyone wants to repay the loan after analyzing their convenience, so try to tailor this feature that could fit perfectly according to everyone’s demand.

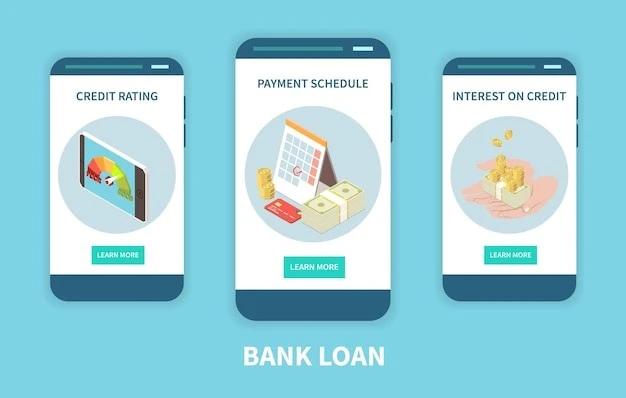

Smart Credit Score Integration

Comparing all the best loan apps in UAE, you will witness credit score feature as the most important thing. It is designed to let the people know whether they are eligible to get a loan or not. It also includes some other features, such as defining the repayment score of different clients. Based on this rating, a user gets to know whether he is becoming defaulter on a particular loan, and how much he needs to pay in order to avoid such drastic event.

Empowering Users with Financial Wisdom

If you want to add something extra in your UAE instant loan app, try adding a separate feature defining how to save some valuable money. This will work as a good tip for those people who do not have enough resources. This will make your instant cash loan app in UAE highly popular, as tips like these always works to get the attention of people. It elevates the word of mouth marketing which is something very necessary for every brand and platform.

Demystifying Instant Loan App Development Costs: Budgeting for Loan Apps in UAE

The development cost of a loan app depends on various factors. Being a project stakeholder, you need to know all of them before setting any core budget for the development. Here are some specific factors that usually plays a big role in defining the cost of a UAE loan app.

Cost-Driven Influences on App Development

The cost of a cash loan app in UAE greatly depends on the features required in the platform. If the core features are quite complex, then it will require better skilled resources. This increases the cost of the app, making it a slightly more pricy as compared to conventional mobile applications.

Unpacking Development Complexity

A lot of times, mobile app requires integration with different third-party services. This is one of those tasks that increases the complexity of development. It should be always done by the skilled resources who’ve got the knowledge of plugins/libraries integration. It enhances the development cost of the project, making it more costly due to the addition of external services.

Design’s Impact on App Investment

The design of the application also brings a huge impact on the overall budget of urgent cash loan app in Dubai. Generally, pre-built templates are used for the designing of mobile applications. However, if you need a custom design, then you will have to open up a bigger purse for the development.

Platform Choices and Their Financial Implications

When developing a loan app, you need to select mobile app development tools and technologies very wisely. It is best recommended to use top-rated platforms for app development. This could increase some of your project cost, but will ensure to provide perfection in every feature and function of the application.

Assembling a Dynamic Development Team

Last but not the least, hiring a dedicated development team can also play a big part in the defining the overall budget of the loan app. If your dev team includes more resources, then the cost of the project will automatically increase.

Frequently Asked Questions (FAQs)

| Why instant loan apps in UAE are getting popular? Mobile loan apps provide a quick solution to many people in terms of granting instant loan. That is why these apps are quickly gaining attention across the UAE. |

| What is the maximum amount of money we can get from loan apps? The maximum amount of loan varies according to the policies of every app. However, as per the general survey, most of the loan apps in UAE provide funds up to AED 50,000. |

| Is there any additional fee associated with these cash loan apps in UAE? Charging any additional fee also depends on the policies of the loan app. Generally, most apps do not charge any fee until you repay the loan within the given timeframe. |

Final Words

That takes us to the end of this blog in which we have listed some of the best loan apps in UAE currently offering lending services to the Emiratis. These apps are offering a great financial service to those people that are in need of some urgent cash. They are fully trusted and always offer funds as per the official financial policies of the UAE government.

Meanwhile, if you are also looking for an IT company that could help you to develop a quality mobile loan app in UAE, get in touch with us today. We will assist you to develop all types of financial apps as per the given requirements.

Empower your digital journey with StruqtIO - Your dedicated partner for cutting-edge custom software development, innovation, and digital transformative solutions. Harness the power of technology to elevate your business and redefine your digital landscape today.