Table Of Content

Discover How You Can Build an App like Cash Now for the UAE Market Successfully

The rise of digital financial services has revolutionized the way people consume goods and services. One such innovation is the instant cash loan model, which has gained immense popularity in recent years. Cash loan apps like Cash Now offer consumers the flexibility to get quick loans and pay for them at a later time, often interest-free.

The success of these apps can be attributed to several factors, including convenience, affordability, and the increasing trend of online shopping. As a result, many entrepreneurs are exploring the opportunity to build their own instant loan apps. However, developing such an app requires careful planning, technical expertise, and compliance with local regulations.

In this comprehensive guide, we will explore the key steps involved in building an app like Cash Now in the UAE. We will also discuss the essential features to include and the regulatory considerations to keep in mind that help professional mobile app development services succeed.

What is Cash Now – A Detailed Exploration of the Popular Instant Cash Loan App

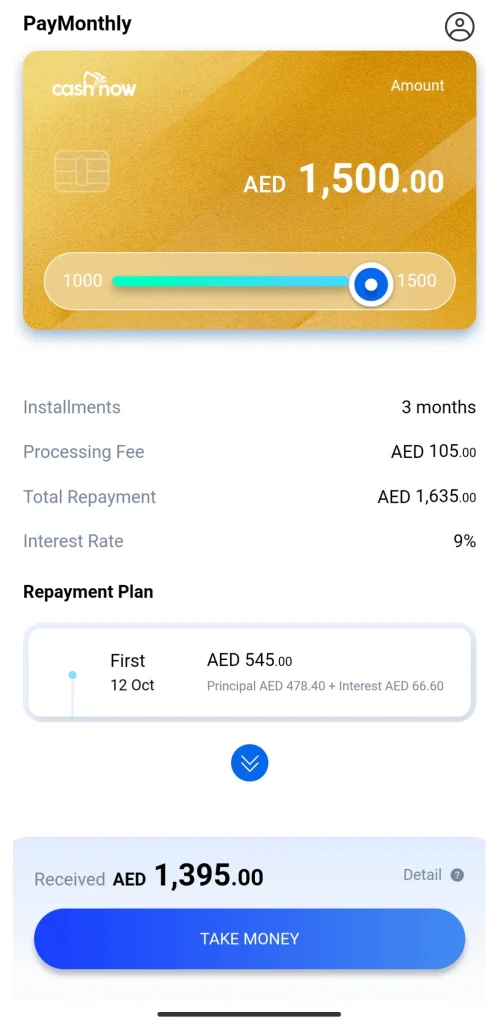

Cash Now is a popular loan app that allows users to get loans and pay them back at a later time. The app has gained significant traction in the UAE due to its user-friendly interface, quick approval process, and wide range of amazing features.

It offers a seamless and convenient experience, enabling users to get approval for their small loans easily and quickly. Key features of Cash Now include:

- Instant Approvals: Users can get instant, seamless, and easy approval process, considering that they are eligible for its use.

- Flexible Payment Plans: Users of Cash Now can choose from various payment plans to suit your budget.

- Secure Transactions: Cash Now employs advanced security measures to protect user data and transactions.

- User-Friendly Interface: The app features a simple and intuitive app design that makes it easy and intuitive to use.

Understanding the Instant Cash Loan Business Model and Its Popularity These Days

The instant loan business model is based on the concept of deferred payments for small loans. Consumers can get loans easily, while they can pay it back later in installments, often interest-free. This is similar to many of the instant cash loan apps in UAE. This model has gained popularity due to several factors:

- Convenience: It apps offer a convenient way to make purchases and manage finances.

- Affordability: By breaking down payments into smaller installments to be paid later, these apps make it easier for consumers to afford larger purchases.

- Financial Flexibility: Consumers can manage their finances more effectively by spreading the cost of purchases without affecting the buying of necessities.

- Financial Inclusion and Access to Credit: These apps can provide access to credit for consumers who may not have traditional credit cards.

- Merchants Benefits: These apps can attract new customers and increase sales for merchants.

The instant cash loan business model is based on providing short-term, interest-free loans to consumers. And with the rising costs across the globe, many people prefer to have the option of spreading out their payments for larger purchases. In the UAE, it has gained popularity due to several factors:

- Consumer Demand: Consumers are increasingly seeking flexible payment options.

- Merchant Perks: It is helping merchants increase sales and enter new customer markets.

- Technological Advancements: Digital payment technologies have made it easier to implement financial solutions.

- Regulatory Support: Many governments, including and outside the UAE, have introduced favorable regulations for cash loan services.

Earning from Your Instant Cash Loan App – What to Know Before You Build App like Cash Now in UAE

The primary purpose of learning how to build an app like Cash Now in UAE would be to earn money through it. The only question is – how? There are multiple ways for you to monetize your loan app.

Therefore, to generate revenue from your app, you can consider one or more from the following strategies.

Membership Fees for Various Tiers of Features and Benefits

Offer tiered membership plans with different features and benefits, charging a monthly or annual fee. For example, you could offer a basic plan with limited features and a premium plan with additional benefits like priority customer support, exclusive discounts, and higher credit limits.

Commission Fees from the Customers Using Your App

Charge a commission fee from consumers for each transaction processed through your app. This fee can be a percentage of the transaction amount or a fixed fee.

Late Payment Surcharges

While many instant loan providers offer interest-free plans, you could consider charging interest on delayed payments. However, this should be done carefully to avoid negative customer sentiment and regulatory issues.

How to Build an App like Cash Now in UAE – Overview of the Early App Creation Process

Now that you know that learning how to build an app like Cash Now in UAE can be hugely beneficial for you, you might be wondering where and how to start that app development process. However, before we get down to creating your cash loan money making apps in UAE, there are a few things you need to take care of.

Let’s take a look at what they are.

Conduct Market Research Extensively

Conducting a through market audit is paramount to your app’s success.

- Identify Your Target Audience: Understand the demographics, preferences, and financial needs of your target customers.

- Analyze the Competitive Landscape: Assess the strengths and weaknesses of existing instant cash loan apps in the UAE market.

- Identify Unique Selling Points: Determine what sets your app apart from the competition. Consider offering unique features or targeting a specific niche market.

- Conduct a SWOT Analysis: Evaluate your strengths, weaknesses, opportunities, and threats to identify potential challenges and opportunities.

Focus on User Experience for Your App’s Design

User experience is one of the most important factors in today’s highly competitive app market. With so many different apps offering more or less the same features, it all comes down to which one makes it more enjoyable for you.

- Prioritize User Needs: Design the app with the user’s needs and preferences in mind. Conduct user research to understand their pain points and expectations.

- Create a Seamless User Journey: Optimize the user flow from registration to checkout, ensuring a smooth and intuitive experience.

- Implement a Clean and Intuitive Interface: Use a minimalist design approach with clear and concise information.

- Optimize for Mobile: Ensure the app is responsive and optimized for various screen sizes, especially if you opt for cross-platform mobile app development.

- Provide Excellent Customer Support: Offer multiple channels of support, such as live chat, email, and phone, to assist users with any issues or queries.

Choose the Right Tech Stack When Building Your Cash Loan App

The right technology stack for your app can help ensure your app’s long-term success.

- Proven Reliability: Select a reliable backend framework, such as Node.js or Python.

- Cross-Platform Compatibility: Choose a suitable frontend framework, such as React Native or Flutter, for cross-platform compatibility.

- Capable of Robust Payment Gateways: Implement a robust payment gateway to process transactions securely.

Ensure Robust Backend Infrastructure for the App

As your user base grows, you will require a robust backend infrastructure to handle that additional traffic load.

- Scalability: Design the infrastructure to handle increasing user traffic and transaction volumes.

- Security: Implement robust security measures to protect user data and prevent cyberattacks.

- Reliability: Ensure high availability and minimal downtime through redundancy and failover mechanisms.

- Performance Optimization: Optimize database queries, API calls, and other backend processes to improve app performance.

Research UAE’s Financial Regulations Compliance Before You Build an App like Cash Now in UAE

One of the reasons that many amateur apps fail is because their creators fail to factor in the local financial regulations, resulting in the app failing its compliance audits.

- Understand the regulatory landscape: Familiarize yourself with the relevant regulations governing financial services in the UAE, including licensing requirements, consumer protection laws, and data privacy regulations.

- Obtain necessary licenses and permits: Secure the required licenses from the relevant authorities to operate a loan business in the UAE.

- Partner with regulated financial institutions: Collaborate with licensed financial institutions to ensure compliance with regulatory requirements and facilitate secure transactions.

- Implement robust risk management practices: Establish effective risk management processes to mitigate risks associated with credit default, fraud, and operational issues.

- Maintain transparency and fair practices: Adhere to fair lending practices, disclose all fees and charges upfront, and provide clear terms and conditions to customers.

Choose the Right App Development Model – In-House Vs Outsourcing

You can essentially choose to hire an in-house development team, or outsource the task to an external software development team who is an expert at that job.

- In-house development requires a dedicated development team but provides greater control over the development process. It can also cost a lot more time and money to hire and manage an in-house team of developers for your app.

- Outsourcing can be a cost-effective option, but it’s important to choose a reliable development partner. Consider factors like experience, expertise, communication, and project management capabilities when outsourcing software development team. Look for a development team that understands the specific requirements of loan apps and can deliver high-quality solutions within budget and timeline constraints.

Top 7 Features Your Instant Cash Loan App like Cash Now Should Absolutely Feature

By following the app development process above and incorporating the essential features, you can build a successful app like Cash Now that meets the needs of your target audience and drives business growth.

- Instant Payments: Enable quick and seamless transactions, processing payments within seconds or minutes to provide a frictionless user experience.

- Highly Secure Transactions: Implement robust security measures such as encryption, tokenization, and biometric authentication to protect user data and prevent fraud.

- Easy-to-Use, UX-Focused User Interfaces: Design an intuitive and visually appealing user interface that is easy to navigate and use. Consider using clear and concise language, simple navigation menus, and informative tooltips.

- Multiple Repayment Options for Customer Flexibility: Offer a variety of payment plans to cater to different customer needs and preferences. This could include fixed installment plans, flexible repayment terms, and early payment options.

- Robust and Quick Customer Support: Provide efficient and timely customer support through multiple channels, such as live chat, email, and phone. Consider using AI-powered chatbots to automate routine inquiries and provide 24/7 support.

- High Availability, Ideally 24/7: Ensure that your app is accessible to users at all times. Implement reliable infrastructure and redundancy measures to minimize downtime.

- Clear Compliance with UAE’s Financial Regulations: Adhere to all relevant regulations to avoid legal issues and maintain a strong reputation. This includes complying with data privacy laws, anti-money laundering regulations, and consumer protection laws.

Marketing Your Cash Loan App: How to Attract Users in UAE

Building a great app is only half the battle. The real challenge begins when you need to attract users in UAE’s competitive instant loan market. Getting your first 10,000 users requires a strategic, multi-channel approach tailored specifically to the UAE audience.

Pre-Launch Strategy: Build Anticipation

Start marketing before your app even launches. Create a landing page with an email signup form offering early access or special launch promotions. Share teasers on social media platforms popular in UAE like Instagram, Facebook, and TikTok. Consider creating educational content about smart borrowing and financial management to establish your brand as trustworthy.

Launch Day Tactics That Work

Offer irresistible launch promotions such as zero processing fees for the first 1,000 users, or bonus credit limits for early adopters. Partner with UAE influencers in the finance and lifestyle space to create authentic content about your app. Run targeted Facebook and Instagram ads focusing on working professionals aged 25-45 in Dubai, Abu Dhabi, and Sharjah.

Strategic Partnerships for Rapid Growth

One of the fastest ways to acquire users is through strategic partnerships:

- Retail Partnerships: Partner with electronics stores, furniture retailers, and fashion outlets to offer instant financing at checkout

- E-commerce Integration: Integrate your loan service with popular UAE e-commerce platforms

- Corporate Partnerships: Work with HR departments of large companies to offer your app as an employee benefit

- Real Estate Agents: Partner with rental agencies to help tenants with security deposit financing

These partnerships give you immediate access to customers who are already in a buying mindset and need financing.

Building Trust in the Financial Space

Trust is everything when dealing with people’s money. Here’s how to build it:

- Share customer testimonials and success stories (with permission)

- Display your UAE regulatory licenses prominently in the app and website

- Create transparent content explaining how your loan process works

- Respond quickly and professionally to all customer inquiries

- Feature your team members to humanize your brand

- Get featured in UAE business and finance publications

Referral Programs That Actually Work

Create a compelling referral program where both the referrer and the new user benefit. For example, offer AED 50 credit to existing users for each successful referral, and give the new user their first loan with zero processing fees. Make sharing easy with built-in social sharing features and unique referral codes.

Content Marketing Specific to UAE

Create valuable content that addresses common financial concerns of UAE residents:

- Blog posts about managing expenses in Dubai

- Videos explaining how instant loans work

- Guides on building credit history in UAE

- Tips for expatriates managing finances abroad

- Comparison articles showing your app’s advantages

Optimize this content for Arabic and English, as both languages are widely used in UAE.

Paid Advertising Budget Allocation

For your first 10,000 users, allocate your marketing budget wisely:

- 40% on social media ads (Facebook, Instagram, TikTok)

- 25% on Google Search ads targeting loan-related keywords

- 20% on partnerships and influencer collaborations

- 10% on content creation and SEO

- 5% on retargeting campaigns

Community Building and Engagement

Don’t just acquire users—engage them. Create a community around smart financial management. Host financial literacy webinars, share money-saving tips, celebrate customer milestones, and create a responsive customer support presence on social media. Engaged users become brand advocates who naturally bring in more users.

Tracking What Works

Use analytics to track which marketing channels bring the highest quality users (those who actually complete loan applications). Focus your budget on channels with the best conversion rates rather than just the most downloads. Popular loan apps in UAE typically see their best results from targeted social media campaigns and strategic retail partnerships.

Conclusion

Building a successful loan app like Cash Now requires a combination of technical expertise, strategic planning, and a deep understanding of the financial industry. By carefully considering the factors outlined in this guide, you can learn how to build an app like Cash Now in UAE that meets the needs of your target audience and drives growth for your business. Even if you opt for offshore software development over in-house teams.

Empower your digital journey with StruqtIO - Your dedicated partner for cutting-edge custom software development, innovation, and digital transformative solutions. Harness the power of technology to elevate your business and redefine your digital landscape today.