Table of Content

Discover How You Can Build an App Like RAKBANK for Your Banking Business

The rise of digital banking has revolutionized the way we interact with financial institutions. Mobile banking apps, like RAKBANK, have become essential tools for managing finances, making payments, and accessing a wide range of financial services. These apps offer convenience, security, and a seamless user experience, empowering customers to take control of their finances. So, you might ask, how to build an app like RAKBANK in 2025?

Building a digital banking app like RAKBANK requires careful planning, technical expertise, and a deep understanding of user needs. It involves a complex interplay of various factors, including robust security measures, seamless user experience, and compliance with regulatory requirements.

In this guide, we will explore the key steps involved in building a successful digital banking app, drawing inspiration from the features and functionalities of RAKBANK. By understanding the core components and best practices, you can create a competitive and user-friendly app that meets the evolving needs of your customers with the help of a professional mobile app development company.

Let’s begin.

RAKBANK Explained – An Overview of the Organization

RAKBANK, or the Ras Al Khaimah National Bank, is a leading commercial bank in the United Arab Emirates, offering a wide range of financial services to both retail and corporate customers. It offers a wide range of banking services, including personal banking, business banking, and corporate banking. The bank has successfully leveraged technology to provide innovative banking solutions, including its mobile banking app.

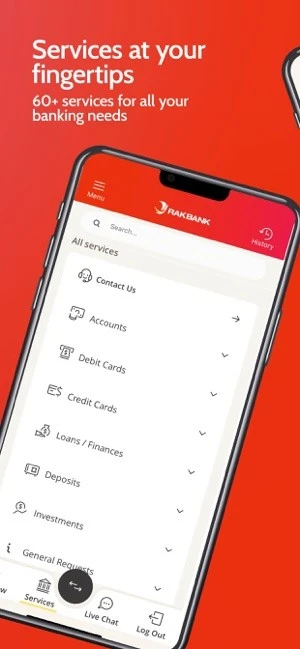

RAKBANK’s mobile app is a testament to its commitment to digital innovation, and is a key component of its digital banking strategy, providing customers with convenient access to their accounts and a variety of banking services. One of the top mobile banking apps in the UAE today, it provides a seamless and secure banking experience, allowing users to manage their finances on the go.

Key features of the RAKBANK app include:

- Account Management: View account balances, transaction history, and account statements.

- Fund Transfers: Transfer funds between accounts, to other RAKBANK customers, or to other banks.

- Bill Payments: Pay bills, such as utility bills, phone bills, and credit card bills.

- Card Management: Manage debit and credit cards, including blocking and unblocking cards, setting spending limits, and disputing transactions.

- Investments: Invest in a range of products, including stocks, bonds, and mutual funds.

- Loans and Finance: Apply for loans and other financing and credit options.

- Customer Support: Access customer support through live chat, email, or phone.

- Security Features: Strong security measures, including biometric authentication and two-factor authentication, to protect user data.

Why Should You Build an App Like RAKBANK for Your Digital Banking Business?

Building a digital banking app offers several advantages for your business. So if you want to know how to build a digital banking app like Mashreq Neobiz or RAKBANK, then here’s how it can help your business grow:

- Enhanced Customer Experience: Provide a convenient and seamless banking experience for your customers.

- Increased Customer Engagement: Encourage frequent interaction with your brand through personalized offers and notifications.

- Improved Customer Loyalty: Build stronger customer relationships through exceptional service and innovative features.

- Cost Reduction: Reduce operational costs by automating processes and reducing reliance on physical branches.

- Competitive Advantage: Stay ahead of the competition by offering cutting-edge digital banking services.

- Data-Driven Insights: Utilize data analytics to gain valuable insights into customer behavior and preferences.

How to Build an App Like RAKBANK in 2025 – A Step-by-Step Guide

By following these steps and leveraging the latest technologies, you can build a successful digital banking app that competes with established players like RAKBANK.

Define Your Target Audience, Objectives, and Business Goals

- Identify Your Target Audience: Determine the specific demographic and needs of your target customers.

- Define Your Unique Selling Proposition: What sets your app apart from other banking apps? Consider offering unique features, such as personalized financial advice, AI-powered chatbots, or gamified savings challenges.

- Establish Your Goals and Objectives: Set clear business objectives, such as increasing customer acquisition, improving customer satisfaction, and boosting revenue.

Choose the Right Technology Stack for Your App’s Future Success

- Backend: Select a robust backend framework like Node.js, Python (with frameworks like Django or Flask), Java, or Ruby on Rails.

- Frontend: Choose a suitable frontend framework like React Native or Flutter for cross-platform compatibility, to store user data and transaction history..

- Database: Select a reliable database system, such as MySQL, PostgreSQL, or MongoDB.

- Cloud Platform: Consider using a cloud platform like AWS, Azure, or Google Cloud for their scalable and reliable infrastructure.

Design a User-Centric Interface for a More Intuitive App Experience

- Intuitive Design: Create a simple and intuitive user interface that is easy to navigate.

- Secure Authentication: Implement robust authentication mechanisms, such as biometric authentication and two-factor authentication.

- Personalized Experience: Use data analytics to personalize the user experience, tailoring the app’s features and content to individual user preferences.

- Accessibility: Ensure the app is accessible to users with disabilities by following accessibility guidelines.

Develop Core Features Needed in a Digital Banking App Like RAKBANK

- Account Management: Allow users to view account balances, transaction history, and account statements.

- Fund Transfers: Enable users to transfer funds between accounts, to other bank accounts, and to mobile wallets.

- Bill Payments: Provide a seamless bill payment experience, including recurring payments and one-time payments.

- Card Management: Allow users to manage their debit and credit cards, including blocking and unblocking cards, setting spending limits, and disputing transactions.

Integrate Additional Features to Allure Consumers Away from Competition

- Investments: Offer investment products, such as stocks, bonds, and mutual funds.

- Loans and Finance: Provide loan and finance options, including personal loans, home loans, and auto loans, as well as personal finance management tools. With RAKBANK one of the top instant cash loan apps in the UAE, your app should offer the feature too.

- Insurance: Offer insurance products, such as life insurance, health insurance, and travel insurance.

- AI-Powered Chatbots: Implement AI-powered chatbots to provide 24/7 customer support.

- Gamification: Use gamification techniques to encourage user engagement, such as rewards, badges, and challenges.

Ensure Data/App Security and Regulatory Compliance

- Data Encryption: Implement strong encryption techniques to protect sensitive user data.

- Secure Authentication: Use strong authentication mechanisms like multi-factor authentication and biometric authentication to enhance security and prevent unauthorized access to accounts.

- Fraud Prevention: Utilize advanced fraud detection techniques to identify and mitigate general fraudulent activities.

- Regular Security Audits: Comply with relevant regulations, such as data privacy laws and cybersecurity standards for data security. Conduct regular security audits to identify and address vulnerabilities, such as the one facing Emirates Investment Bank recently.

- Compliance with Regional Regulations: Adhere to relevant regional regulations, such as GDPR and PCI DSS, to protect user data from fraud and malicious use.

Comprehensive Testing and Quality Assurance Exercises

- Functional Testing: Test all features and functionalities to ensure they work as expected.

- Performance Testing: Evaluate the app’s performance under heavy load to identify and fix bottlenecks.

- Security Testing: Conduct security testing to identify and address vulnerabilities.

- User Acceptance Testing: Involve real users to test the app’s usability and functionality and identify areas for improvement.

Launch Your App and Promote It to Your Target Audience

- App Store Optimization: Optimize your app’s listing on app stores to improve visibility and downloads.

- Marketing and Promotion: Create a comprehensive marketing strategy to promote your app through social media, content marketing, and paid advertising.

- User Acquisition: Implement effective user acquisition strategies, such as referral programs and partnerships.

- Customer Support: Provide excellent customer support to address user queries and resolve issues promptly.

Additional Considerations When Creating an App Like RAKBANK for 2025 and Beyond

Besides the features and elements to be aware of that we have discussed above, the modern tech-driven industry demands something more. That ranges from simply carefully tracking and identifying changing technology trends and incorporating them on time, to looking for strategic partnerships to stand out in the market. These considerations include:

- Emerging Technologies: Stay updated with the latest technological advancements, such as blockchain and artificial intelligence, to enhance your app’s capabilities.

- Continuous Improvement: Regularly update and improve the app based on user feedback and evolving market trends.

- Strategic Partnerships: Collaborate with other financial institutions and fintech companies to expand your offerings.

- Third-Party Integrations: Integrate with third-party services, such as payment gateways, e-commerce platforms, and investment platforms.

- Effective Marketing Strategy: Develop a comprehensive marketing strategy to promote your app and attract new users.

- Social Media Marketing: Utilize social media platforms to engage with your target audience and build brand awareness.

- Influencer Partnerships: Collaborate with influencers to reach a wider audience and generate buzz.

Conclusion

In today’s digital age, a robust mobile banking app is essential for any financial institution to remain competitive. By following the steps outlined in this guide and considering the key factors discussed, you can build a successful digital banking app that rivals industry leaders like RAKBANK.

Remember, the key to success lies in providing a seamless user experience, prioritizing security, and staying ahead of technological advancements. Continuously monitor user feedback, analyze usage patterns, and iterate on your app to ensure it remains relevant and user-friendly. By investing in innovation and customer satisfaction, you can build a loyal customer base and drive long-term growth for your digital banking business.

Empower your digital journey with StruqtIO - Your dedicated partner for cutting-edge custom software development, innovation, and digital transformative solutions. Harness the power of technology to elevate your business and redefine your digital landscape today.