Table of Content

Best Fintech Mobile Apps in the Middle East Trusted by Everyone

The fintech industry in the Middle East is rising quite rapidly. Many top global names have launched their operations in the region to explore immense opportunities of this market. They understand that fintech apps are connected directly with the people, hence the chances of rapid growth are countless in this market. Due to the ease of conducting/managing digital transactions, people also want to use top fintech mobile apps in Middle East that are offering unique features. This is the core reason why these apps are getting popular in the market, attracting more and more users regularly.

The good thing about fintech apps is that they can be accessed by everyone. The business theme of most of these apps follows the B2C model, which is what gives them the ability to connect directly with the people. The services of these apps however differ from each other, as some platforms offer money transfer services, while some currency converter apps offer simple exchange services. It is up to the people to select and use these apps based on their needed requirements.

If you are also living in the UAE, you must need to know about the top fintech mobile apps in Middle East that are used by everyone. In this blog, we will enlist some of them, so that you can know which app should be used to conduct online transactions. Let’s first start from the basics understanding what is a fintech app, and why its demand is increasing rapidly in the Middle East.

What is a Fintech App?

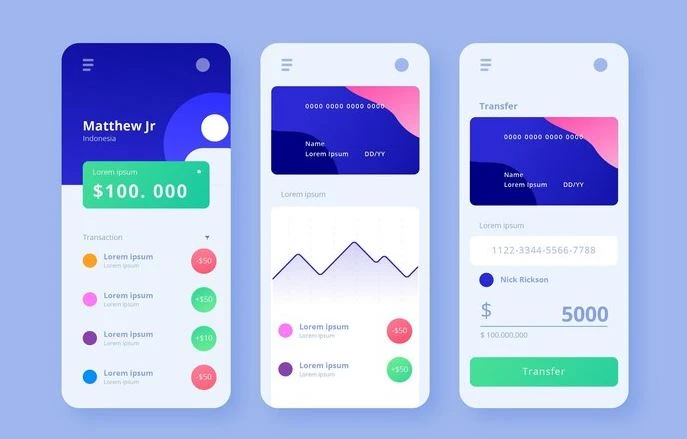

A fintech app, short for financial technology application, is a software-based platform that leverages cutting-edge technology to provide innovative financial services and solutions. These applications are built by a mobile app development company to enhance and streamline various aspects of financial activities, offering users convenient access to a wide range of financial services through their smartphones, tablets, or other digital devices. Fintech apps often incorporate elements of artificial intelligence, machine learning, data analytics, and blockchain technology to revolutionize traditional financial processes.

The core objective of fintech apps is to democratize finance, making it more accessible, efficient, and user-friendly for individuals and businesses alike. Users can manage their finances, make payments, transfer funds, invest, and access a multitude of financial products and services seamlessly. Fintech apps may also include features like budgeting tools, real-time financial insights, and personalized recommendations based on user behavior and preferences. The agility of fintech apps allows them to adapt quickly to changing market dynamics, fostering a dynamic landscape within the financial industry.

Mobile app security and trust are paramount in the realm of fintech apps, as they handle sensitive financial information. Therefore, these applications implement robust encryption protocols, multi-factor authentication, and other security measures to ensure the confidentiality and integrity of user data. The continuous evolution of fintech apps reflects a broader trend towards digital transformation in the financial sector, challenging traditional banking models and promoting financial inclusion on a global scale.

Why Fintech Apps Are Popular in the UAE?

Fintech apps have gained significant popularity in the UAE due to a combination of factors that align with the country’s dynamic and tech-savvy environment. The UAE has a rapidly growing young population with a high smartphone penetration rate, creating a conducive environment for the adoption of digital financial services. The government’s commitment to innovation and technology, coupled with a proactive regulatory framework, has encouraged the development and adoption of different payment gateways in the UAE, making the country a fertile ground for these applications.

One key reason for the popularity of fintech apps in the UAE is the emphasis on financial inclusion and providing services to the unbanked and underbanked populations. Fintech apps offer a convenient and accessible way for individuals and businesses to manage their finances, make transactions, and access a variety of financial services without the need for a traditional bank account. This is particularly significant in a country with a diverse expatriate population, where fintech apps can bridge gaps in financial access and cater to the needs of a diverse customer base.

Furthermore, the UAE has a thriving startup ecosystem, with a supportive infrastructure for entrepreneurship and innovation. Fintech startups have flourished, introducing disruptive technologies and business models that resonate with the local population. The country’s commitment to becoming a global hub for technology and finance has further fueled the popularity of fintech apps, attracting investment and fostering a competitive landscape. The convenience of these apps have positioned them as integral components of the UAE’s financial ecosystem, meeting the evolving demands of a digitally-driven society.

Top Fintech Mobile Apps in Middle East 2025

The popularity of fintech industry is scaling up in the Middle East, which is why we are seeing a quick rise of advanced fintech apps in this region. There are plenty of applications currently functional in the market, however, we will enlist only the top fintech mobile apps in Middle East that are used by the masses. Let’s take a quick look at them below.

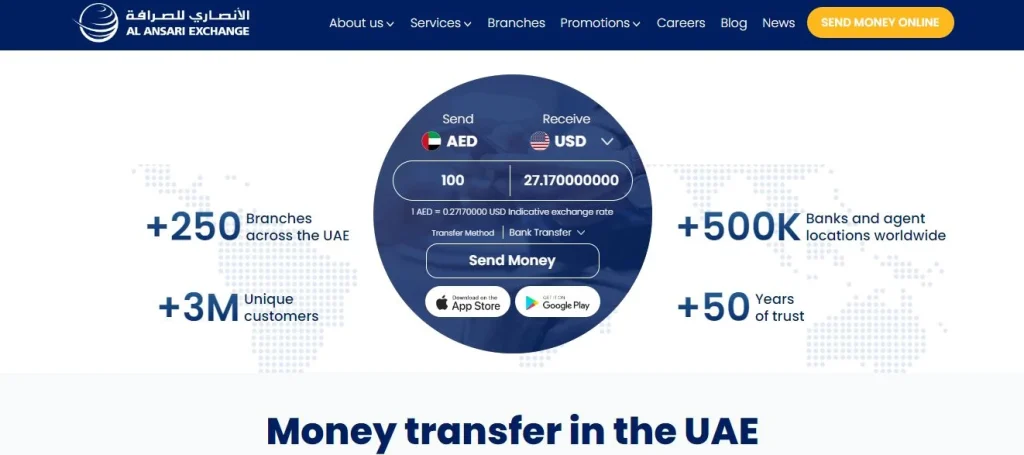

Al-Ansari Exchange

Al Ansari Exchange stands out as a prominent financial institution in the United Arab Emirates, renowned for its extensive network of over 200 branches across the country. With a dedicated workforce of over 3000 multi-lingual professionals, the company is committed to providing millions of customers with swift, reliable, and efficient financial services. The vast branch network ensures that Al Ansari Exchange is readily accessible to a diverse customer base, contributing to its status as a leading exchange company in the region.

A key facet of Al Ansari Exchange’s commitment to customer convenience is its innovative mobile app. This digital platform empowers users to send money online with unprecedented ease, speed, and security. The app facilitates anytime, anywhere transactions, allowing customers to manage their financial activities seamlessly. Moreover, the Al Ansari Exchange mobile app offers a range of advanced features, including multiple payment options and the advantage of securing the best exchange rates for money transfers.

In addition to the convenience of online transactions, the Al Ansari Exchange mobile app is designed to cater to the evolving needs of its users. Beyond facilitating money transfers, customers can explore a suite of additional features that enhance their overall financial experience. These may include real-time exchange rate information, transaction history tracking, and personalized notifications. Al Ansari Exchange’s commitment to providing a comprehensive and secure mobile banking experience positions the app as a valuable tool for individuals seeking financial flexibility and control.

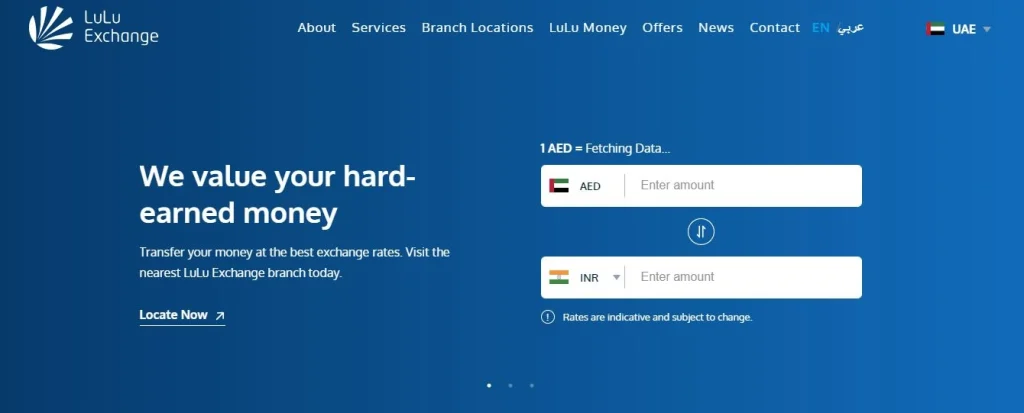

LuLu Money

Lulu Money stands out as one of the prominent money remittance companies in the United Arab Emirates, offering a comprehensive one-stop solution for individuals seeking efficient and secure financial transactions. Renowned for its extensive reach, users can leverage Lulu Money to send funds to over 100 countries worldwide, providing a seamless and rapid remittance experience. The company’s commitment to customer satisfaction is reflected in its user-friendly interface and swift processing times, making it a go-to choice for those with diverse remittance and payment needs in the UAE.

In terms of user engagement, Lulu Money has garnered substantial traction, evident in its impressive download statistics. The mobile app has been downloaded over 890K times, underlining its popularity among a significant user base. This substantial user community underscores the trust and reliability users place in Lulu Money for their remittance requirements. Furthermore, the app boasts a noteworthy accomplishment, having successfully processed over 876,000 transactions. This numerical testament highlights the app’s efficacy and reliability in facilitating a high volume of financial transactions for UAE residents.

The success of Lulu Money can be attributed not only to its broad reach and user engagement but also to its commitment to leveraging technology for streamlined financial services. The app’s ability to facilitate transactions within a few seconds aligns with the fast-paced nature of modern financial demands. Beyond its primary function as a remittance platform, Lulu Money likely provides users with additional features such as real-time exchange rate information, transaction tracking, and perhaps even personalized recommendations.

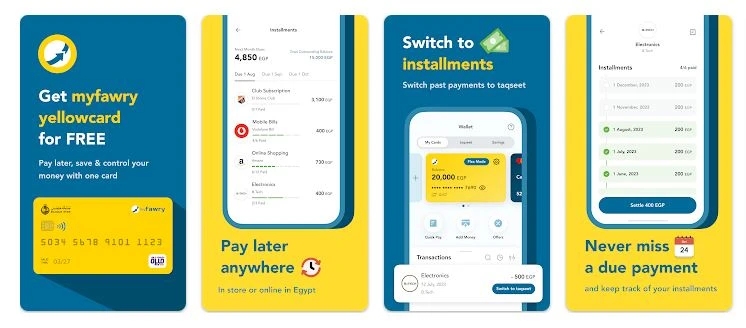

myFawry

Fawry emerges as a pioneering force in Middle East’s digital transformation and FinTech landscape. The pltaform sets itself apart by offering an extensive portfolio of over 1,186 financial services, catering to the diverse needs of both individual consumers and businesses. Operating through an expansive network of more than 225 thousand locations, Fawry provides a seamless and user-friendly approach to bill payments and a spectrum of other financial services, available across various channels such as online platforms, ATMs, mobile wallets, and retail points.

The huge range of Fawry’s services reflect its strategic placement in the financial landscape. The platform’s commitment to offering a multitude of financial services underscores its adaptability to the evolving digital finance landscape. Fawry’s strategic positioning across diverse channels enables users to choose the most convenient method for their financial transactions. This diverse accessibility not only enhances user convenience but also positions Fawry as a versatile and inclusive financial solution provider.

The myFawry mobile app serves as the gateway to Fawry’s extensive array of payment services, encapsulating the platform’s commitment to user-centric technology. This app transforms the payment experience, bringing Fawry’s diverse financial functionalities within easy reach through a simple tap. Beyond its core function as a payment facilitator, the myFawry app integrates additional features, such as real-time transaction tracking, personalized financial insights, and potentially even supplementary services to augment the overall user experience.

Tabby

Tabby has emerged as a prominent Fintech application in the Middle East lately. This user-friendly financial technology solution has garnered substantial support from major brands across the region. With Tabby, the convenience of deferred payments has become a prevalent feature at various points of sale (PoS) and checkouts, establishing its presence in numerous stores and malls throughout the United Arab Emirates. Tabby’s Fintech solution stands out by providing a range of benefits to its users, including the option for interest-free installments, cashback on purchases, exclusive discounts, and more.

The widespread adoption of Tabby in stores and malls underscores the app’s seamless integration into the retail landscape of the UAE. As consumers increasingly opt for flexible payment solutions, Tabby’s presence at PoS and checkouts has become a common sight, offering a convenient and transparent approach to managing purchases. Beyond just facilitating deferred payments, Tabby’s Fintech solution likely encompasses a user-friendly interface and additional features, such as real-time transaction tracking, personalized spending insights, and more others.

Tabby’s commitment to providing unlimited benefits to its users adds a layer of appeal to its Fintech offering. The provision of interest-free installments, cashback incentives, and exclusive discounts not only aligns with the evolving preferences of modern consumers but also positions Tabby as a comprehensive financial solution that goes beyond the conventional buy-now-pay-later model. As the Fintech landscape in the Middle East continues to evolve, Tabby’s ability to collaborate with major brands positions it as a notable player in the region’s financial technology sector.

Money Fellows

Money Fellows has positioned itself as a sophisticated digital mobile application, boasting a vast user base of over 4 million individuals who trust the platform. Going beyond traditional financial models, the app has successfully digitized the age-old concept of money circles, transforming it into a contemporary, user-friendly mobile application. This innovative approach ensures that users can seamlessly navigate and engage with the app, all while safeguarding their financial well-being.

The app’s success in amassing a significant user base underscores its effectiveness in addressing the diverse financial needs of individuals. With over 4 million trusted users, Money Fellows has become a go-to platform for those seeking an alternative and technologically advanced means of financial management in the UAE. Beyond the sheer number of users, the app likely integrates cutting-edge features to enhance the overall user experience, potentially offering tools for goal setting, personalized financial insights, and real-time tracking of financial activities.

Money Fellows’ unique value proposition extends to the promise of the highest returns on users savings. By curating a diverse range of money circles, the app aims to maximize the benefits for its users. This strategic focus on optimizing returns sets Money Fellows apart, positioning it as an attractive option for individuals looking to not only manage their finances but also to make their money work harder for them. As the app continues to evolve, it remains a noteworthy player in the circuit of digital financial solutions.

StruqtIO: Build Exceptional Fintech Apps Powered by Latest Technologies

Having immense dev industry experience, StruqtIO is a definite source where you can get advanced fintech app development solutions. We have got the expertise to transform ideas into real applications. We always pay attention to develop custom fintech apps complying with all the industry standards and rules defined by the financial regulatory body of the UAE.

Besides mobile app development, we can also help you to develop other advanced software products. From .NET applications to database development, and cloud integration to software QA testing, our teams can accommodate all the requirements that relates with your business needs. So, give us a quick call today if you want to develop a fintech app or any other software solution as per the latest industry trends.

Frequently Asked Questions

| What is fintech application? A fintech application is a digital platform that leverages technology to provide innovative financial services and solutions. These applications aim to enhance efficiency, accessibility, and user experience within the financial industry. |

| Why fintech app are getting popular in the UAE? Fintech apps are gaining popularity in the UAE due to a tech-savvy population, government support for AI innovation in Dubai, and a proactive regulatory environment. The apps cater to diverse financial needs, contributing to their widespread adoption. |

| Which fintech apps are more popular in the UAE? Many fintech apps are currently functional in the UAE, and some of them are highly popular in the industry. It includes Al Mulla Exchange, MyFatoorah, vaLU, Al-Ansari Exchange and more others. |

Final Words

That takes us to the end of this blog in which we have listed some of the top fintech mobile apps in Middle East working currently. Knowing about these applications is important, because they provide a platform to conduct digital transactions swiftly. This blog has listed popular fintech apps that are used by the masses in the Middle East. These apps are fully regulated, complying with all the rules and guidelines defined by the UAE authorities.

If you are also looking to develop a fintech app like the ones defined above, get in touch with us today. Our teams will work dedicatedly on your project, ensuring to build quality fintech apps as per the given requirements.

Empower your digital journey with StruqtIO - Your dedicated partner for cutting-edge custom software development, innovation, and digital transformative solutions. Harness the power of technology to elevate your business and redefine your digital landscape today.