Table of Content

Discover How Does Upside Make Money to Find Your App’s Perfect Revenue Stream

Ever wondered how a cashback app can afford to give users money back on everyday purchases while remaining profitable? Upside, formerly GetUpside, has cracked the code on this, and has built a $1.5 billion company that helps 30 million people save over $2 billion annually.

The secret to how does Upside make money while giving back to their consumers, lies in their innovative business model. And what a great model it is, that creates genuine value for all stakeholders – consumers, partners, and the Upside app itself.

When you as a consumer is earning cashback on gas, groceries, and dining without paying any fees, you might start to wonder how the service provider earns, and from who does it earn that revenue. In Upside’s case, the company has built multiple revenue streams that result in a sustainable and profitable business.

Understanding Upside’s revenue model reveals interesting insights into how modern data-driven businesses create win-win scenarios. Discover how the company has established a sizable cash flow, and learn how professional mobile app development services can help you achieve the same too, positioning you as a leader in the competitive cashback industry.

How Does Upside Make Money? Overview of the Business Model and Revenue Streams

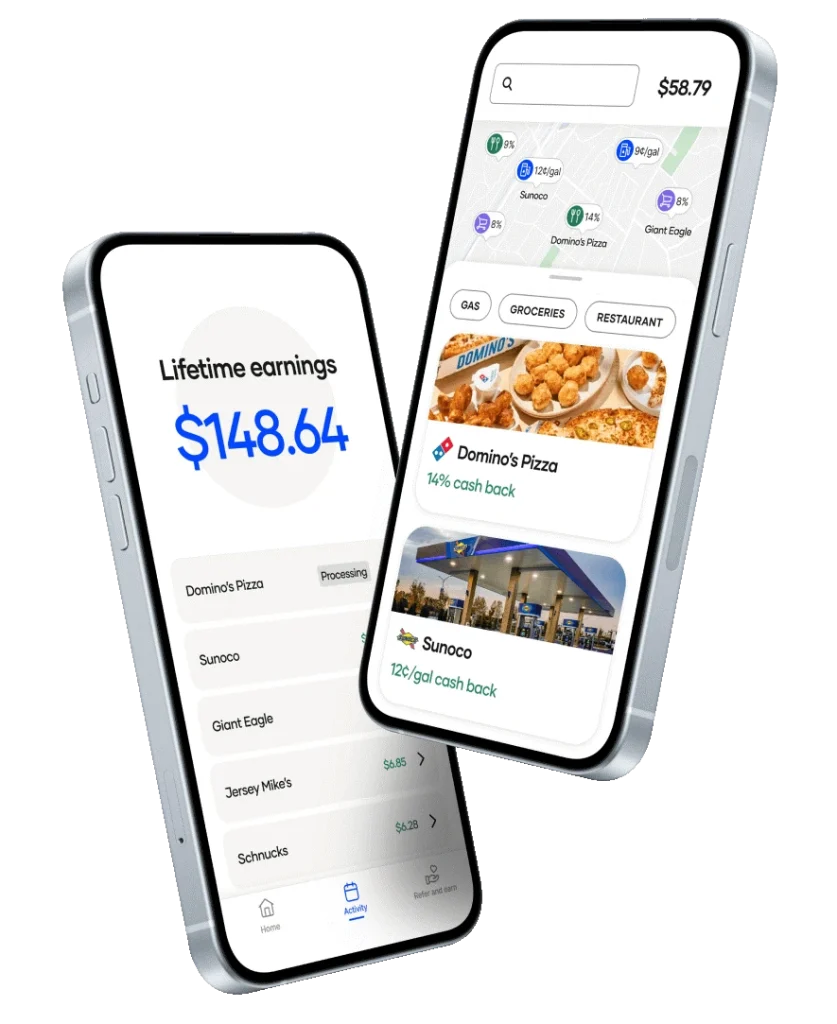

Upside operates a sophisticated platform-based business model that generates revenue through various interconnected streams while providing genuine value to both consumers and businesses. The Upside Business Model is centered around offering cashback rewards to its users for making online purchases through its website and app, but the underlying mechanics involve much more complex revenue generation strategies that ensure profitability while maintaining user satisfaction.

The platform functions as a two-sided marketplace where Upside drives value to both businesses and consumers through strategic partnerships and data-driven insights. On the business side, it offers a cost-effective way to acquire new customers and increase sales volume, while on the consumer side, it helps people save money on their everyday purchases without changing their shopping habits. This dual value proposition forms the foundation of how Upside makes money by creating scenarios where all parties benefit from increased transaction volume and customer engagement.

Upside’s marketplace app development revenue model relies on a commission from each transaction and building long-term relationships with consumers and merchants. The combination of consumer savings and merchant growth creates a win-win scenario that enables sustainable revenue generation. Unlike traditional advertising models, Upside doesn’t charge upfront fees to businesses, instead earning money only when they can prove incremental value through increased customer traffic and sales volume, making their success directly tied to partner success.

Upside’s Primary Revenue Stream – Affiliate Partners’ Commissions

The majority of Upside’s revenue comes from affiliate commissions received from its network of over 50,000 partners across various retail categories. Upside targets various businesses who remit a commission on every sale that is made through the use of the app. This commission is charged either as a percentage of the amount realized on the sale or as a per transaction basis, creating a performance-based revenue model that aligns Upside’s interests with those of their merchant partners.

When a user activates an offer through the Upside app and makes a purchase at a partnered location, Upside earns a commission on that purchase. Think of it as a referral fee – Upside brings in new customers for the business, and in return, the business shares a portion of the sale. Commission rates vary significantly depending on the merchant category and specific partnership terms, with some partners paying as little as 4.5% for pizza orders while grocery purchases might generate 9% commissions for Upside.

The affiliate commission model proves particularly effective because it ensures that Upside only gets paid when they deliver measurable value to their business partners. Upside matches every user with 10 to 100 non-Upside users who have similar buying habits through sophisticated test-versus-control analysis, allowing them to demonstrate exactly how the platform affects consumer behavior and drives incremental sales. This proven incremental impact justifies the commission payments and enables Upside to maintain strong relationships with retail partners while scaling their revenue alongside partner success.

Revenue from Extensive Data Analytics and Market Insights

Upside collects and analyzes vast consumer and market data to provide valuable insights to businesses, creating a significant secondary revenue stream through data monetization strategies. This data is collected from various sources, including customer transactions, preferences, and behavior patterns, which Upside then processes to create valuable market intelligence that helps businesses optimize their marketing strategies and customer acquisition efforts.

According to GDPR guidelines, aggregate data—which is personal data processed for statistical purposes—is not considered ‘personal’ data, allowing companies like Upside to monetize anonymized consumer insights legally and ethically. There is a great deal of demand for this data because cash-back systems handle retail sales transactions that provide deep insights into consumer spending patterns, geographic preferences, and purchasing behaviors across multiple retail categories.

Upside monetizes this data by selling access to its data analytics platform and providing customized reports and insights to its clients, in line with modern data visualization best practices. The company leverages machine learning algorithms that have been trained on millions of data points, including geolocation and debit/credit card transactions of its clients, to present personalized offers and generate valuable market insights. This data-driven approach not only enhances user experience through better personalization but also creates additional revenue opportunities through B2B data services.

Revenue Generated Via White-Label Solutions and Technology Licensing

Upside offers white-label solutions to companies wanting to leverage its technology and platform for customer loyalty and cashback programs, representing a growing and potentially lucrative revenue stream. By licensing its technology and customizing its platform to match the branding and requirements of partner companies, Upside generates revenue through licensing fees and ongoing support services while expanding its market reach through established brands.

Small and medium-sized businesses can use Upside’s partner APIs to deliver personalized promotions to people directly in their own branded app, creating seamless integration opportunities that benefit all parties involved. Companies of all sizes can utilize the Upside partner API to give users tailored deals right in their own applications, eliminating the need for businesses to develop complex cashback infrastructure from scratch while providing Upside with recurring revenue from technology licensing.

Major partners utilizing Upside’s white-label solutions include industry leaders like Uber, Current, GasBuddy, and Lyft, demonstrating the scalability and attractiveness of this revenue model. These partnerships enable ride-hailing and delivery platforms to allow their drivers and users to directly benefit from Upside’s cashback rewards without leaving their primary applications. As a result, Upside receives substantial referral revenue from these APIs while expanding their user base through established platforms, creating a compound growth effect that strengthens their market position.

Revenue Generation Via API Integration and Partnerships

Upside has developed sophisticated API integration capabilities that allow partner companies to embed cashback functionality directly into their existing applications, creating additional revenue streams through partnership agreements and revenue sharing arrangements. Ride-sharing platforms like Uber and Lyft drivers see cash back offers right in their apps, helping drivers save money while strengthening Upside’s role in the transportation ecosystem and generating ongoing revenue through these strategic integrations.

The numbers demonstrate the effectiveness of Upside’s API integration strategy: partner apps see 60% more user sessions monthly when Upside’s offers are integrated, while monthly retention rates grow by 40% with Upside’s cashback features. These improvements in user engagement and retention provide significant value to partner companies, justifying revenue sharing agreements that benefit both parties while expanding Upside’s reach to over 35 million consumers – more than one in ten Americans.

Strategic partnerships and integrations substantially boost Upside’s growth and market position beyond direct revenue generation. White-label solutions and API integrations create a strong ecosystem that works for businesses, consumers, and Upside alike, with these revenue sources likely to become even more important as the platform grows and improves its offerings. The success of partnerships with companies like DoorDash, Instacart, and GasBuddy demonstrates how Upside makes money through strategic collaborations that expand their market reach while providing value to established platforms seeking to enhance user engagement and retention.

How Does Upside Make Money – Their Profit-Sharing Model Explained

Upside operates on a unique profit-sharing structure that ensures the company doesn’t make money until both customers and businesses benefit from transactions, creating a sustainable and ethical approach to revenue generation. Upside doesn’t charge fees upfront, with money coming in only when both customers and businesses benefit from transactions, as evidenced by their success in getting $1.3 billion in profit for retailer partners while maintaining user satisfaction and engagement.

The profit-sharing model in eCommerce software development works by ensuring that businesses earn a profit on every transaction generated through Upside’s platform, or they don’t pay any fees to the company. This approach has earned Upside great ratings with 4.8 out of 5 stars on the App Store and 4.7 out of 5 stars on Google Play, demonstrating that their win-win approach resonates with users who appreciate genuine value rather than exploitative business practices.

Upside’s commitment to driving value extends through their business model philosophy: “Upside doesn’t make money until our users and retailer partners do first. And if we can’t prove that we helped, then we don’t get paid. Period.” This ethical stance differentiates them from competitors who might prioritize short-term revenue extraction over long-term value creation. The company’s ability to demonstrate measurable incremental impact through sophisticated analytics ensures that their profit-sharing arrangements remain mutually beneficial and sustainable for all parties involved.

Increasing Revenue Generation By Adopting Tech Trends and Machine Learning

Upside employs sophisticated machine learning technology to surface personalized offers to its users, creating additional revenue opportunities through improved conversion rates and enhanced user engagement. The personalization technology feeds various anonymized data points into its algorithms, including a user’s spending history retrieved from debit/credit card transactions and their location data, enabling highly targeted offers that increase transaction likelihood and overall platform value.

Every consumer receives a personalized offer during every purchase, with the customization optimized over time to increase revenue and sales for both Upside and their merchant partners. The AI-driven personalization can display additional products that customers wouldn’t have thought of buying before, resulting in increased sales volume and profits for partners, which ultimately translates to higher referral fees for Upside through their commission-based revenue model.

Smart analysis of user activity demonstrates real business results that justify how Upside makes money through technology-enhanced revenue generation. The platform’s machine learning capabilities enable cross-shopping benefits that Kevin Hart, Upside’s Chief Sales Officer, points out are essential in today’s retail environment where shoppers spend money across many retail categories. By leveraging advanced algorithms and data analysis, Upside creates more valuable offers for users while generating higher commissions from merchant partners, demonstrating how technology innovation directly contributes to revenue growth and business sustainability.

Market Expansion and Revenue Opportunities – What Does the Future Look Like for Upside?

Upside has significant potential for market expansion, especially since being crowned one of the best gas and grocery rewards app. Market expansion represents one of Upside’s biggest opportunities, as the company can expand its operations into new regions, tap into a broader user base, and increase its revenue streams beyond their current focus on gas stations, restaurants, and grocery stores in select markets.

Diversification of partnerships offers another substantial growth vector, as Upside can explore partnerships with new industries and businesses beyond fuel retailers and grocers, increasing the range of cashback options for users while creating new commission revenue opportunities. Integration with other platforms presents additional revenue potential, as Upside can explore integrations with existing popular platforms like e-commerce websites or smartphone wallets to extend its reach and simplify the user experience.

Enhanced personalization capabilities through advanced AI and machine learning could further improve how Upside makes money by increasing user engagement and transaction frequency. Upside can leverage its user data to provide even more personalized offers and recommendations, further improving the user experience and driving user engagement while creating opportunities for premium services and enhanced partnership arrangements. The company’s current valuation of $1.5 billion and growth trajectory suggest that these expansion opportunities could significantly multiply their current $128 million annual revenue through strategic execution and continued innovation.

FAQs

| Does Upside make money by selling user data? Upside states that they do not sell personal user data to third parties. However, like many platforms in the cashback industry, they do monetize anonymized and aggregated data for market insights and analytics services. According to GDPR guidelines, aggregate data processed for statistical purposes is not considered ‘personal’ data, allowing companies to legally monetize such insights while protecting individual privacy. Upside uses this data primarily to improve their personalization algorithms and provide market intelligence to business partners. |

| How much commission does Upside earn from merchant partners? Commission rates vary significantly depending on the merchant category and specific partnership agreements. For example, Upside earns approximately 4.5% commission on pizza orders from partners like McDonald’s, while grocery purchases might generate up to 9% commission rates. The exact commission structures are typically kept confidential between Upside and their merchant partners, but these rates generally range from 3% to 15% depending on the industry, transaction volume, and partnership terms. |

| Can businesses join Upside for free? Yes, businesses can join Upside without upfront fees or setup costs. The platform operates on a performance-based model where merchants only pay when Upside demonstrably drives incremental sales and profits. If Upside can’t prove that they helped increase business revenue, then the merchant doesn’t pay anything. This approach reduces risk for businesses while ensuring that Upside’s success is directly tied to merchant partner success. |

| How does Upside’s white-label solution generate revenue? Upside generates revenue from white-label solutions through licensing fees and ongoing support services provided to partner companies who want to implement cashback functionality in their own branded applications. Major partners like Uber, Lyft, and GasBuddy pay licensing fees to integrate Upside’s technology, while Upside also earns referral revenue when users complete transactions through these partner APIs. This creates recurring revenue streams while expanding Upside’s market reach through established platforms. |

| What makes Upside different from other cashback apps? Upside differentiates itself through its profit-sharing model where they don’t make money until users and merchants benefit first, sophisticated machine learning for personalized offers, and focus on proving incremental impact rather than just facilitating existing purchases. Unlike competitors who might rely primarily on affiliate commissions, Upside has diversified revenue streams including data analytics, white-label solutions, and API partnerships. Their commitment to demonstrating measurable value through test-versus-control analysis sets them apart in the competitive cashback industry. |

Conclusion

Understanding how Upside makes money reveals a sophisticated multi-revenue stream business model that prioritizes genuine value creation for all stakeholders. Through affiliate commissions, data analytics, white-label solutions, and strategic partnerships, Upside has built a sustainable $128 million annual revenue business that continues growing while maintaining user satisfaction and merchant partner loyalty.

The company’s profit-sharing approach ensures that Upside only succeeds when their users and business partners benefit first, creating an ethical and sustainable foundation for long-term growth. With a $1.5 billion valuation and expansion opportunities in new markets and categories, Upside demonstrates that cashback platforms can build substantial businesses while providing genuine value to consumers and merchants.

As the digital payments landscape continues evolving, Upside’s technology-driven approach and multi-faceted revenue model position them well for continued success. Their ability to prove incremental impact, maintain strong partner relationships, and expand into new revenue streams through API integrations and white-label solutions suggests that the question of how Upside makes money will become even more interesting as they scale their operations and explore new market opportunities.

Empower your digital journey with StruqtIO - Your dedicated partner for cutting-edge custom software development, innovation, and digital transformative solutions. Harness the power of technology to elevate your business and redefine your digital landscape today.