Table of Content

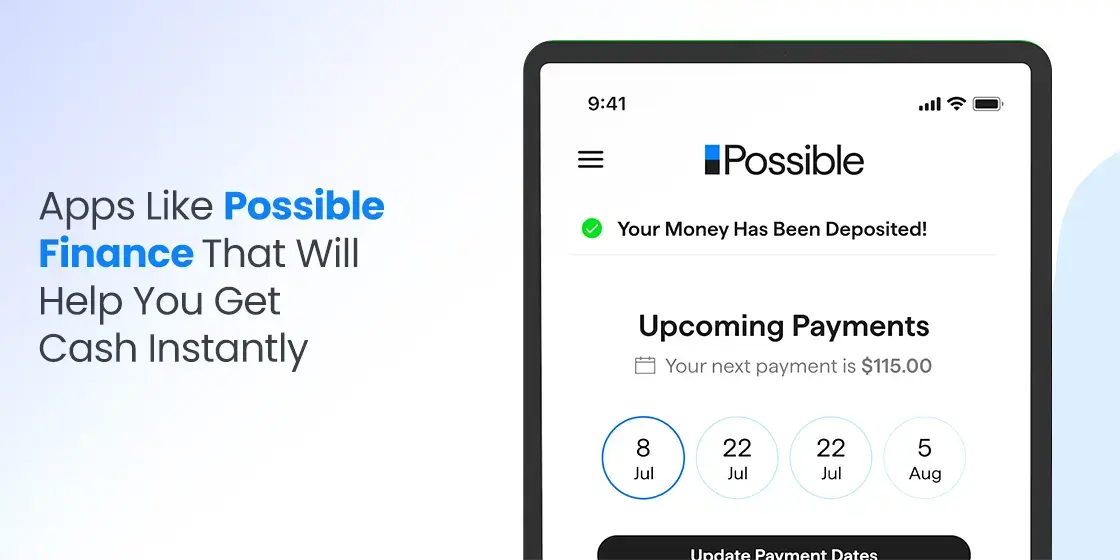

Discover How Apps Like Possible Finance Can Empower Financial Freedom in 2025

In today’s fast-paced world, unexpected financial needs can occur at any time. Traditional financial institutions such as banks and loan offices often have rigid processes and lengthy approval times for loans, as well as requirements such as a good credit score. As a result, many people are turning to fintech apps that offer quick and convenient access to cash.

One such app is Possible Finance, which provides instant cash advances to users. However, there are numerous other apps that offer similar services, each with its own unique features and benefits.

In this article, we’ll explore some of the top apps like Possible Finance developed by some of the best mobile app development services today, that can help you access instant cash in the UAE.

Possible Finance Explained – What is It?

Possible Finance is a financial technology company that offers a range of financial services, including instant cash advances. Considered one of the top fintech mobile apps in the Middle East, it uses advanced algorithms to assess a user’s financial health and determine their eligibility for a cash advance.

To qualify for a cash advance, users must meet certain criteria, such as having a positive payment history and a stable income. Once approved, users can receive a cash advance of up to a specific amount, which is typically repaid through automatic deductions from their direct deposit.

Why Do People Need Apps Like Possible Finance in the UAE?

Instant cash loan apps in the UAE are often a necessity these days. While traditional banking systems can be slow and bureaucratic, fintech apps like Possible Finance offer a quick and convenient solution. Here’s why people in the UAE might need such apps.

1. Bridging Paycheck Gaps

- Irregular Income: Individuals with irregular income streams, such as freelancers or gig workers, may experience periods of financial uncertainty between paychecks.

- Delayed Payments: Unforeseen delays in salary disbursement can lead to immediate financial needs.

2. Unexpected Expenses

- Emergency Expenses: Unexpected medical bills, car repairs, or home emergencies can drain financial resources.

- Seasonal Expenses: Expenses related to specific seasons, such as travel or holiday shopping, can strain budgets.

3. Avoiding High-Interest Loans

- Alternative to Payday Loans: Apps like Possible Finance offer a more affordable alternative to high-interest payday loans.

- Building Credit: By responsibly using these apps and making timely repayments, individuals can improve their credit scores.

4. Financial Flexibility

- Quick Access to Funds: These apps provide a quick and easy way to access funds when needed.

- Financial Safety Net: Having access to a small, short-term loan can serve as a financial safety net.

By offering a convenient and affordable solution to these financial challenges, apps like Possible Finance can empower individuals to manage their finances more effectively and avoid falling into debt.

Top 7 Apps Like Possible Finance That Can Be Used for Instant Cash in 2025

Here are some of the top apps similar to Possible Finance that can provide quick cash advances.

FloatMe

FloatMe is a popular app that allows users to access a portion of their earned wages early. It’s a great option for those who need quick cash to cover unexpected expenses or to bridge the gap between paychecks.

Key Benefits of FloatMe:

- Financial Flexibility: Access your earned wages early to cover unexpected expenses.

- Avoid Overdraft Fees: Prevent overdrafts by accessing your earned wages.

- Improve Financial Health: Make timely payments and avoid late fees.

- User-Friendly Interface: A simple and intuitive app.

LenMe

LenMe is a user-friendly financial app that provides instant cash advances of up to $250. It’s designed to help you manage your finances effectively and avoid unexpected financial setbacks.

Key Features of LenMe:

- Instant Cash Advances: Access funds quickly and easily.

- Budgeting Tools: Track your spending and set financial goals.

- Financial Tips: Receive personalized financial advice to improve your money management skills.

- Easy Repayment: Repay your cash advance through automatic deductions from your paycheck.

Albert

Albert is a sophisticated financial assistant app that leverages AI to provides cash advances, budgeting tools, and personalized financial advice. It can help you track your spending, set financial goals, and make smarter financial decisions.

Key Features of Albert:

- Cash Advances: Access cash advances to cover unexpected expenses.

- AI-Powered Financial Advice: Get tailored financial advice based on your spending habits.

- Budgeting Tools: Track your spending, set budgets, and monitor your financial progress.

- Investment Advice: Receive personalized investment recommendations.

- Savings Goals: Set savings goals and track your progress.

Cleo

Cleo is a unique financial chatbot that offers a fun and engaging way to manage your money. It provides a range of financial services, including cash advances, budgeting tools, and financial advice.

Key Features of Cleo:

- Cash Advances: Access instant cash advances to cover unexpected expenses.

- Budgeting Tools: Set budgets, track spending, and receive personalized financial advice.

- Financial Education: Learn about personal finance topics through interactive chat sessions.

- Bill Payment Reminders: Get reminders for upcoming bills to avoid late fees.

Kora

Kora offers short-term loans and cash advances to help you cover unexpected expenses. The app also provides budgeting tools and financial education to help you improve your financial health.

Key Features of Kora:

- Instant Cash Advances: Receive cash advances quickly and easily.

- Flexible Repayment Options: Choose a repayment plan that suits your budget.

- Financial Education: Access tips and advice to improve your financial literacy.

- Budgeting Tools: Track your spending and set financial goals.

Solo Funds

Solo Funds is a convenient financial app that offers instant cash advances. It’s designed to provide quick financial relief when you need it most.

Key Features of Solo Funds:

- Instant Cash Advances: Access funds quickly and easily.

- Flexible Repayment Options: Choose a repayment plan that suits your budget.

- User-Friendly Interface: A simple and intuitive app.

Varo

Varo is a mobile-only bank that offers a range of financial services, including checking and savings accounts, debit cards, and overdraft protection. It’s a great option among the top mobile banking apps in UAE for those looking for a convenient and fee-free banking experience.

Key Features of Varo:

- Early Direct Deposit: Get your paycheck up to two days early.

- Fee-Free Checking and Savings: No monthly fees, no overdraft fees, and no minimum balance requirements.

- Overdraft Protection: Avoid overdraft fees with Varo’s built-in protection.

- Cash Back Rewards: Earn cash back on purchases with a Varo Visa Debit Card.

- Financial Insights: Track your spending and set financial goals.

Conclusion

Apps like Possible Finance have revolutionized the way we access quick cash. These apps offer a convenient and affordable alternative to traditional loans, helping users manage unexpected expenses and financial emergencies.

When choosing a cash advance app, it’s important to consider factors such as fees, interest rates, repayment terms, and additional features like budgeting tools and financial advice. By carefully evaluating these factors, you can select the best app to meet your specific needs.

Remember to use these apps responsibly and to repay your loans on time to avoid additional fees and negative impacts on your credit score.

Empower your digital journey with StruqtIO - Your dedicated partner for cutting-edge custom software development, innovation, and digital transformative solutions. Harness the power of technology to elevate your business and redefine your digital landscape today.