Table of Content

Understand the Core Development Process of BNPL Apps like Afterpay

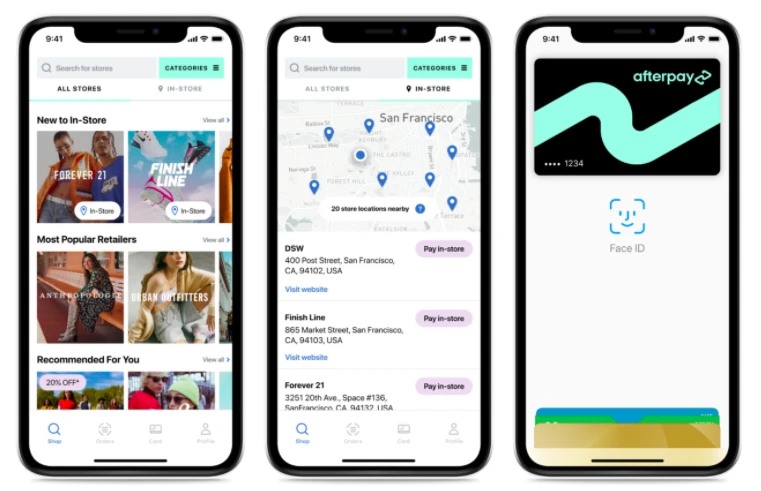

Ecommerce businesses always try to come up with new ideas to gain more and more customers. Recently, many businesses are promoting the concept of BNPL which basically refers to paying later for the product purchases. Some apps like Afterpay have used this concept quite remarkably. People are now showing interest in BNPL apps to make their online shopping easy. Looking at this, many businesses want to know how to develop apps like Afterpay. It refers to a new online shopping concept that helps to attract more people towards stores that are even new to the circuit.

But developing an app like Afterpay isn’t that easy as it looks. There are various things you need to keep in mind when developing a BNPL app. First of all, you should try to take app development services from a professional agency if you are not well versed with the custom development. This is a preferred method for those who do not have internal development teams or technical resources.

On the other hand, those who can develop such advanced apps internally need to pay attention to the process correctly. This blog will let you know how to develop apps like Afterpay right from the beginning. Let’s start from the basics understanding why BNPL concept is getting popular in the market.

What Makes BNPL Apps Popular?

Buy Now, Pay Later (BNPL) apps are gaining popularity due to their convenience and flexibility. They allow consumers to make purchases immediately and spread the payments over time, often in interest-free installments. This model appeals to a wide range of consumers, especially younger demographics who may not have access to traditional credit or prefer not to use credit cards. The seamless integration of BNPL options into online and in-store checkouts makes the process fast and user-friendly, enhancing the overall shopping experience.

Economic factors also contribute to the rise of BNPL services. With inflation and rising costs of living, consumers are looking for ways to manage their cash flow more effectively. BNPL provides a short-term financing solution without the burden of interest or the fear of long-term debt, which is often associated with credit cards and loans. This makes it attractive for budget-conscious shoppers who want to make essential or high-ticket purchases without immediate financial strain.

Moreover, the marketing strategies and partnerships of BNPL providers have fueled their growth. These companies often collaborate with popular retailers, which incentivizes customers to use their services. Additionally, the rise of e-commerce and digital transactions has created a fertile ground for BNPL adoption, as consumers seek fast, digital-first payment methods. The combination of financial accessibility, convenience, and strategic positioning has made BNPL a compelling option for modern consumers.

How to Develop Apps like Afterpay: Exploring the Key Points

To develop an app like Afterpay, a step-by-step process should be followed to meet the core project objectives. If you do not know much about the development strategy of BNPL apps, take a look at the points defined below.

Review the Market

Prior to initiating the development of your application, it is essential to carry out comprehensive market research. This process should involve analyzing current UAE tech trends, and identifying key features that resonate with users in the Buy Now, Pay Later (BNPL) market. By doing so, you can gain a clear understanding of what is currently popular and what unique value your app can offer to the customers. This foundational knowledge will help guide your product strategy and ensure that your app addresses real user problems.

Additionally, understanding your target audience in depth is crucial. Explore their demographics, pain points, and their overall expectations from financial technology applications. Surveys, focus groups, and user interviews can be valuable tools in this phase. By aligning your development goals with actual user needs and market demands, you increase the likelihood of building a product that not only stands out in a competitive space but also gains traction and builds user trust from the outset.

Choose App Functionalities

The next important step involves selecting the features and functionalities that will be integrated into your BNPL app. This means prioritizing tools and services that align with user expectations and industry standards. Start by identifying core functionalities such as user registration, credit checks, payment scheduling, notifications, and transaction history. Your goal should be to create a user experience that is intuitive, secure, and tailored to the needs of your target audience.

In addition to basic features, think strategically about how your app can stand out in a crowded marketplace. Review the feedback and pain points users have expressed about existing BNPL solutions. Every feature you choose should serve a clear purpose, whether it’s improving usability, ensuring compliance, or enhancing customer satisfaction—and contribute to building a reliable and user-centric BNPL experience.

Begin App Development

At this stage, it is time to implement the functionality into the app’s frontend interface. This involves translating wireframes and user flows into interactive elements, such as buttons, menus, and dashboards. The goal is to create a smooth user experience where individuals can easily navigate the app, complete transactions, view payment schedules, and access customer support without confusion or delay. Also, attention to detail in the frontend will play a major role in user satisfaction and retention.

Simultaneously, the outsourced development team should focus on building a robust backend system architecture that supports all app operations securely and efficiently. This includes setting up databases, APIs, servers, and other infrastructure components necessary to handle user data. Proper planning of the backend architecture ensures scalability, and performance, especially as user demand grows. It is also important to implement security protocols and compliance measures to protect sensitive financial information and ensure regulatory adherence within the BNPL ecosystem.

Ensure App Quality

The next crucial step is to carry out comprehensive software testing to ensure the app performs reliably and securely across all intended use cases. This process should begin with functional testing to verify that each feature works as expected under normal conditions. Usability testing is also essential to assess how intuitive and user-friendly the app interface is for real users. This may involve observing users as they complete key tasks, identifying areas where they encounter confusion or friction.

In addition to functionality and usability, a strong focus must be placed on identifying and addressing security vulnerabilities. This involves conducting penetration tests, reviewing code for security flaws, and ensuring that sensitive user data. It’s also important to test how the system handles edge cases, high traffic loads, and potential failure scenarios. By thoroughly testing the app from every angle, you can catch and fix issues early, strengthen the app’s integrity, and build user trust before launch.

Frequently Asked Questions

| What is Afterpay? Afterpay is a “buy now, pay later” service that lets customers split purchases into four interest-free payments. It allows users to receive items immediately while paying over time. |

| Why BNPL apps are becoming popular in the market? BNPL apps are gaining popularity due to their convenience and interest-free payment options, making purchases more affordable. They also appeal to younger consumers seeking alternatives to credit cards. |

| How do BNPL apps make money? BNPL apps make money primarily through merchant fees for offering their service at checkout. They also earn from late payment fees charged to users who miss installment deadlines. |

Final Words

That takes us to the end of this blog in which we have discussed how to develop apps like Afterpay. It is quite evident by the market trend that apps like Afterpay are gaining popularity in the market. People are loving the concept of BNPL, as it provides them a leverage to pay for the purchases later on. This article has taken a quick overview how such apps can be built. It is therefore a good read for those who want to learn the basics of app development, especially the currently trending BNPL ecommerce apps.

Empower your digital journey with StruqtIO - Your dedicated partner for cutting-edge custom software development, innovation, and digital transformative solutions. Harness the power of technology to elevate your business and redefine your digital landscape today.